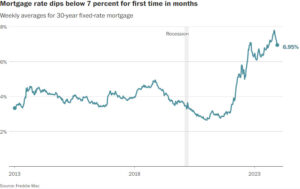

30-year rate remains far higher than before 2021 but is dropping amid expectations of what the Fed will do next year

By Tory Newmyer | The Washington Post

Aspiring home buyers grappling with the most difficult housing market in nearly 40 years are finally seeing some relief.

Borrowing costs for 30-year fixed-rate mortgages dropped below 7 percent this week for the first time in four months, according to the housing-finance giant Freddie Mac on Thursday. Just six weeks ago, the average rate for those home loans peaked at 7.8 percent, a high not seen since 2000; now it stands at 6.95 percent.

Pressure on the battered real estate market look poised to ease further. The Federal Reserve on Wednesday held off raising interest rates, extending its pause to three rate-setting meetings in a row, as its policymakers projected that they would cut their benchmark rate by 0.75 of a percentage point by the end of next year.

Investors see the move as confirmation that the central bank has ended its war on inflation and will take a more hands-off approach to guard against an economic downturn. For home buyers, the Fed’s decision should add momentum to an improved outlook, even though housing experts say meaningful mortgage-rate relief could still be months away.

Borrowing costs remain more than double what they were early last year, and real estate prices remain elevated. That has kept the inventory of for-sale home low because existing homeowners have more incentive to stay put if moving means taking on a costlier home loan.

But with rates starting to fall, there already are signs that buyers are rejoining the hunt. Mortgage applications, which in October sank to their lowest level since 1995, have been ticking up since, the Mortgage Bankers Association reported.

Read More (subscriber content)

Some stories may only appear as partial reprints because of publisher restrictions.