By Emily Badger & Francesca Paris | The New York Times

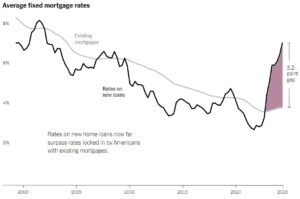

Something deeply unusual has happened in the American housing market over the last two years, as mortgage rates have risen to around 7 percent.

Rates that high are not, by themselves, historically remarkable. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points lower.

Source: Federal Housing Finance Agency analysis. Note: New loan figures show the predicted rate that existing

mortgage holders could get on the same mortgages at new market conditions.

The gap that has jumped open between these two lines has created a nationwide lock-in effect — paralyzing people in homes they may wish to leave — on a scale not seen in decades. For homeowners not looking to move anytime soon, the low rates they secured during the pandemic will benefit them for years to come. But for many others, those rates have become a complication, disrupting both household decisions and the housing market as a whole.

Indeed, according to new research from economists at the Federal Housing Finance Agency, this lock-in effect is responsible for about 1.3 million fewer home sales in America during the run-up in rates from the spring of 2022 through the end of 2023. That’s a startling number in a nation where around five million homes sell annually in more normal times — most of those to people who already own.

These locked-in households haven’t relocated for better jobs or higher pay, and haven’t been able to downsize or acquire more space. They also haven’t opened up homes for first-time buyers. And that’s driven up prices and gummed up the market.

Another way to state how unusual this dynamic is: Between 1998 and 2020, there was never a time when more than 40 percent of American mortgage holders had locked-in rates more than one percentage point below market conditions. By the end of 2023, as the chart below shows, about 70 percent of all mortgage holders had rates more than three percentage points below what the market would offer them if they tried to take out a new loan.

For all the stories this picture tells, the big one it captures is a stuckness in the housing market that may also be feeding broader frustration with the economy.

To show how we got here, consider the distribution of rates held by all American homeowners with fixed-rate mortgages, going back in time.

In the late 1990s and early 2000s, at the beginning of the timeline covered by the F.H.F.A. analysis, most homeowners had rates between about 7 and 9 percent. Rates then fell with the dot-com recession, and dropped further coming out of the Great Recession. Many homeowners also refinanced along the way.

Then early in the pandemic, rates bottomed out at historical lows, giving many households bargains below 3 percent.

For most of this period of generally declining rates and regular refinancing, most homeowners held rates that weren’t so different — within a single percentage point or so — from what they could get on a new loan. If you held a mortgage rate higher than the market, that made moving or refinancing relatively painless. If you held a lower one, the difference was seldom big enough to discourage people from changing homes.

But that shifted significantly in the last two years as the Fed battled inflation, and as interest rates on all kinds of loans spiked.

It might seem strange to suggest there’s a problem now with so many people having scored great housing deals during the pandemic. The problem arises from the fact that rates rose from their pandemic low so high, so fast. Seemingly overnight, most American homeowners with mortgages found themselves in a situation where it might now feel financially foolish to sell their home.

Read more (subscriber content).

Some stories may only appear as partial reprints because of publisher restrictions.