By Prashant Gopal | Bloomberg

Raad Yousif drives his pickup truck past cactuses and sandstone cliffs, hunting for Phoenix’s best real estate bargains. On this December weekday, he pulls into a subdivision of blocky pueblo-inspired town homes from the 1970s, the bare, dusty landscaping evoking the surrounding desert.

The 31-year-old Iraqi immigrant knows the neighborhood well. He got his start in the city as a janitor at Phoenix Sky Harbor International Airport, just a five-minute drive away. Now his passion is flipping homes. And he’s quite good at it. He figures he made $200,000 buying and selling them in the two-year pandemic-fueled housing boom.

Yousif punches in a code and swings open the door to his most lucrative 2022 flip, a two-bedroom town home in this development. He unloaded it last spring, just as the market was starting to sink. Big institutions from Silicon Valley and Wall Street were still on a buying binge, at times making unbelievable offers sight unseen. In this case a company called Opendoor Technologies Inc. in April paid $265,000—$30,000 above the five other bidders, he says.

Opendoor is now asking $218,000, a $47,000 loss, not including its fees and renovation expenses. But even that asking price is too high, Yousif says. After four price cuts, he smells blood. He’s eager to buy back the home he once owned. “It’s always about the right number,” he says. Opendoor says such losses reflect an unprecedented market decline.

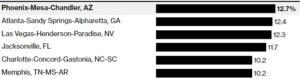

Where Big Investors Buy

US metro areas with the highest share of existing home purchases made by large investors in 2022

Includes metropolitan statistical areas with at least 20,000 purchases.

Source: SFR Analytics

In this slice of the Sonoran Desert, the roles of vulture and carrion have suddenly reversed. First-time buyers and small investors have the upper hand on supposedly sophisticated players that badly misjudged the market. It’s quite a turnabout. More than a decade ago, Arizona was at the center of a foreclosure wave that hit local mortgage borrowers the hardest. Private equity firms swept into Phoenix and other once-hot US markets to buy at pennies on the dollar. This time it’s the so-called smart money getting played.

The pattern is unfolding across the Sun Belt but nowhere more than in the Phoenix area, where institutions represented a bigger share of home purchases last year than in any other major US market, according to real estate data firm SFR Analytics. These companies included a new breed of homebuyer that bought and sold residential properties like securities, figuring they could diversify their holdings by balancing a three-bedroom in the suburbs with a town house in the city.

Harnessing technology to crunch data, Opendoor and others said they could make transactions quickly and nearly pain-free. It all sounded so cool and new. Borrowing a page from Apple’s Steve Jobs, they called themselves iBuyers.

Today, Phoenix illustrates some of the advantages of the old, slow, analog ways. As homes started to trade like initial public offerings, prices became more volatile on the way up—and down.

Laurie Tayrien, a former schoolteacher, and her husband, Rick, love the new market. They just snapped up the deal of a lifetime for a Phoenix three-bedroom built in the 1980s. Surrounded by golf courses, below a mountain vista, it was quite an upgrade from their previous home, in a crime-ridden neighborhood.

In November the Tayriens paid $485,000 for what they call “their forever home.” In June the seller, Opendoor, had paid $646,800. That’s a 25% loss in just five months.

Before they were married, the Tayriens had each suffered through foreclosure proceedings during the 2008 financial crisis, while Wall Street profited. Now it’s their turn. The couple are busy on a $50,000 renovation of their kitchen, where plywood counters wait to be topped in quartz. The Tayriens have the cash in part because of a bungled bet by a big institution. “They rode a wave, and it’s crashing on them,” Laurie says. “It’s a corporation. I don’t feel bad for them.”

Buyout firm KKR, Barry Sternlicht’s Starwood Capital Group and private equity firm Cerberus also hoovered up homes—in their case, to rent them out as corporate landlords. Unlike Opendoor and other iBuyers, private equity firms are buy-and-hold investors who own homes for many years. But like the tech companies, they drove up prices as repeat buyers armed with giant pools of capital.

A Wild Ride

Weekly median home sale price, by trailing four-week period

Source: Redfin

Even when it became clear to many local analysts that the market was stalling, the iBuyers and other institutions kept purchasing. In April, the Cromford Report, a Phoenix data firm, put out a “red flag” to its 2,000 subscribers, who are mostly local agents, appraisers and investors. It warned that the slump had already begun.

Read more (subscriber content)

Some stories may only appear as partial reprints because of publisher restrictions.