Back in January of this year, Influencer Marketing moderator Fletcher Wilcox (The Wilcox Report) led a panel of local real estate experts that included Jim Daniel (RL Brown Housing Reports), Tina Tamboer (The Cromford Report) and Tom Ruff (The Information Market). Their focus was on local housing futures before COVID-19 hit.

Here is how their predictions panned out against the pandemic:

Wilcox

- Inventory will be tight

- Purchase prices are going to rise

- There will be more new home sales

- Expect interest rates to be low

- There will be lots of competition

New listings in 1Q2020 were down 7% compared to 1Q2019. Then came COVID and YOY new listings dropped even further…until the beginning in July when more sellers listed their homes. Year-over-year listings for the second half of 2020 were higher than 2019, but the number of buyers greatly outpaced the number of sellers. Active inventory was no longer measured in estimated months of supply but in days or hours. Overall, the total number of New Monthly Listings in 2020 (78,500) will end up about two percent less than 2019 (80,280).

The Median Purchase Price in January 2020 was $320K. December’s MPP will end around $375K; which is $55K or 17% higher than January — this increase is the highest in seven years! It would not be a surprise to see the MPP at $400K by mid-year 2021.

Because the number of active single family resales listings was so low, many potential buyers looked at buying a new home. From January through October 2020, there were 2,580 or 15% more new home sales than in 2019.

Interest rates not only stayed low in 2020, they got lower. According to Freddie Mac, the 30-year fixed interest rate averaged 3.5% in 1Q2020 and will end the year around 2.9%. Very low interest rates, combined with a fast-growing population, fueled demand to own which kept inventory low and prices high.

According to the U.S. Census Bureau annual population report, Arizona finished third in numeric population increase for the second consecutive year; gaining 129,558 people or an average of 355 per day. The daily increase in population greatly increased competition amongst buyers for whatever homes might be on the market.

Daniel

- There will be more New Home Sales because of affordability and inventory

- The difference in the MPP for New from Nov 2019 to Nov 2020 is +$28,990

- The difference in the MPP for Resale from Nov 2019 to Nov 2020 is +$61,103

The post-Covid effect on New home sales has been negligible to date. With low resale listings and resale appreciation, new homes have become the affordable option. Looking at Median Purchase Price for both new homes and resale really tells the story:

New Home closing activity should remain strong through the first half 2021 based on the fact that 15,972 new home permits have been issued in the past 6 months.

Tamboer

- Prices will continue to rise as long as:

- Incomes continue to rise

- Mortgage Rates remain stable

- Affordability remains normal

- The Luxury Market is going gangbusters

Private sector earnings rose…not as robustly of course, but respectfully up 3.8% year over year as of November 2020 despite the unemployment crisis.

Mortgage rates were not stable, but continued to decline which fueled demand even more.

Affordability as of the 3rd Quarter was still in normal range; although I’m not expecting that for 4Q2020 or 1Q2021.

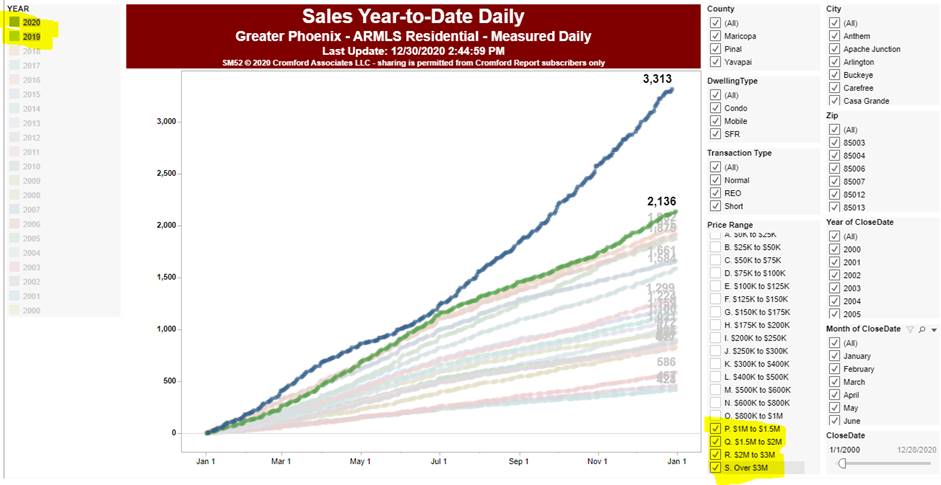

Luxury Sales did indeed go gangbusters…

Prices continue to rise, fueled by record-low interest rates and compounded by the greatest luxury demand Greater Phoenix has ever seen!

Ruff

- We will exceed sales expectations in the first three months of the year

- Prices are going up, but transactions won’t decline in the first quarter

- We will see a decline in foreclosures during the first three months of 2020

Volume was up 10.57% in 1Q2020 compared to 1Q2019

Average Sales Prices were up 11.2% and Median Sales Prices were up 13.3%

New Residential Eviction Notices were down 10.35%, Foreclosures were down 33.69%.

Changes for the entire year were even more dramatic. I will publish those numbers in the next two weeks at https://armls.com/statistics.

Related: Influencer Marketing: 2020 Forecast Highlights (Jan. 24, 2020)