By Ashley Gurbal Kritzer | Tampa Bay Business Journal

Long before the novel coronavirus pandemic sent Americans racing for their smartphones to order groceries, industrial real estate observers were keeping a close eye on the availability of temperature-controlled warehouses.

COVID-19 vaccines that require very specific temperatures — Moderna Inc.’s vaccine requires temperatures of minus-20 degrees Celsius and Pfizer Inc.’s candidate requires storage at minus-70 degrees Celsius — have put cold-storage warehouses in the spotlight in recent weeks. But the sector has seen little vacancy for years, and industrial real estate experts don’t expect that to change as consumers shift more of their food shopping online, even after the pandemic is in the past.

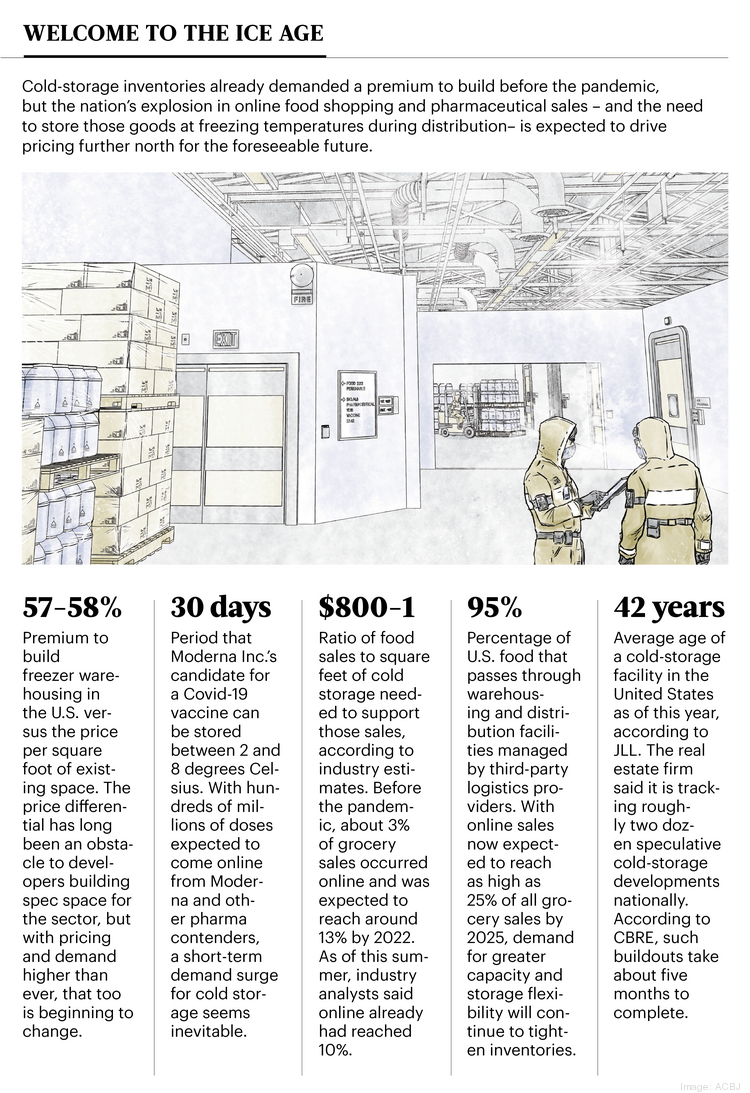

Historically, the national vacancy rate of cold-storage warehouses has hovered below 10%, according to JLL, and much of that inventory is aging and rapidly approaching functional obsolescence. The average cold-storage warehouse in the U.S. is 42 years old, according to JLL.

“If we have a client who wants to know all the available temperature-controlled storage in the U.S. … on any given day, this isn’t something that takes up 10 pages,” said Tray Anderson, Cushman & Wakefield Inc.’s logistics and industrial lead for the Americas. “It’s more like two or three.”

The lack of available space is a function of economics: Temperature-controlled warehouses cost nearly twice as much to build as their dry-storage counterparts, according to JLL, which forecasts that those construction costs will only rise as demand intensifies. A temperature-controlled warehouse can cost $130 to $180 a square foot, whereas construction costs for a conventional warehouse range from $70to $90 a square foot. That pricing makes speculative construction — breaking ground without a signed tenant in place — difficult but not impossible, said Anderson, who is based in North Carolina.

But the uptick in demand from food companies and retailers — coupled with the variable of a massive vaccine-distribution effort — is enough to embolden some developers to try their hand at speculative construction. Already, 95% of U.S. food goes through a third-party distribution center before it reaches consumers, according to CBRE Group Inc. And as early as May 2019, CBRE predicted that the country needed an additional 75 million to 100 million square feet of cold-storage space to meet demand for direct-to-consumer food orders — and that was before the pandemic threw online ordering of everything from furniture to food into overdrive.

Read More (subscriber content)