By Angela Gonzales | Phoenix Business Journal

For the first time since the Great Recession, metro Phoenix has dipped into negative home price growth territory, according to the latest S&P Corelogic Case-Shiller Indices released April 25.

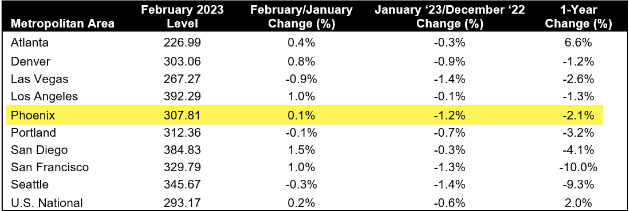

Metro Phoenix saw a 2.1% slide in year-over-year home price growth, joining seven other metros across the country in negative territory, including Denver, Las Vegas, Los Angeles, Portland, San Diego, San Francisco and Seattle.

Sources: S&P Dow Jones Indices and CoreLogic Data thru Feb. 2023.

Phoenix was negative year-over-year every month from February 2007 to February 2010, according to Case-Shiller data, due to lingering effects of the Great Recession. For the 12 months ended March 2009, Phoenix prices were down a whopping 36%. Growth also was negative every month from January 1990 to October 1991.

This is a far cry from Phoenix home price growth topping the nation for three years in a row until last spring. Even when Phoenix dropped to second place nationwide in March 2022, it was still showing a 32.4% gain in home price growth.

See more (subscriber content)

Some stories may only appear as partial reprints because of publisher restrictions.