By Julie Z. Weil | The Washington Post (abridged)

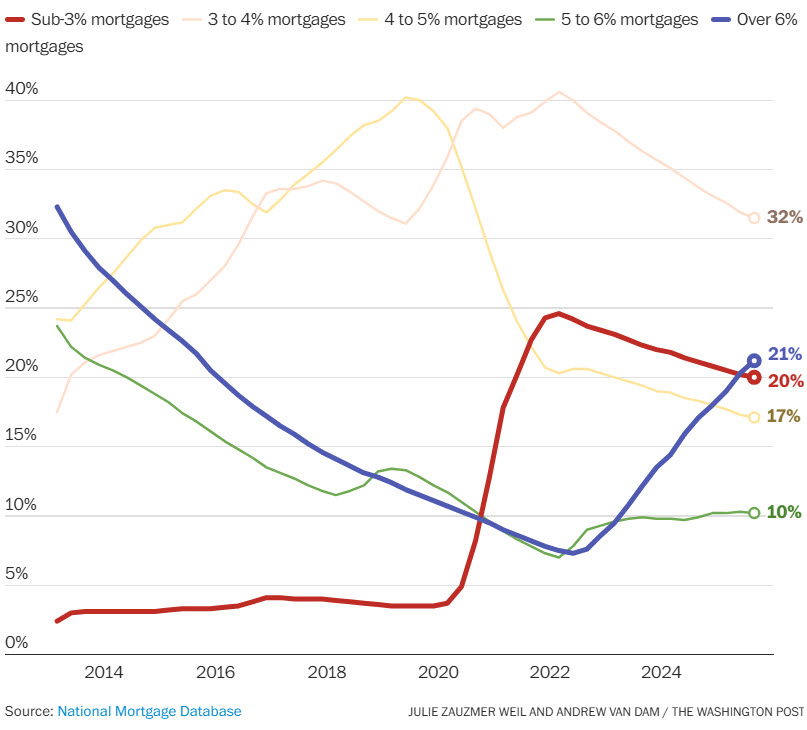

The housing market recently crossed a noteworthy line: There are now more Americans with mortgage rates higher than 6 percent than below 3 percent.

It matters because those ultralow, pandemic-era rates — while great for the homeowners who nabbed them — have been something of a problem for the housing market ever since.

People are loath to sell their homes when it means giving up a cheap loan for a significantly more expensive one. Mortgage rates have more than doubled since 2021, when a 30-year loan could be had for less than 3 percent, Federal Reserve data show, and they have remained above 6 percent for more than three years.

Homeowners with low rates stayed put, and the ensuing drop in home listings gave rise to an inventory crunch and surging property prices — a dynamic known as the “mortgage lock-in effect.”

More Americans now have mortgage rates above 6% than below 3%

More than half of all mortgages are still below 4% rates, though, so the mortgage lock-in effect isn’t over.

Now, the lock-in effect might be easing.

“The direction going forward will be higher average interest rates for homeowners, and that’s actually a good thing, because it’s going to reduce the lock-in effect,” said Nick Gerli, chief executive of the real estate app Reventure, who pointed out the mortgage rate crossover on the social media site X. “We are going to see potentially a lot more inventory in the future, as that lock-in effect just continues to weaken.”

People with low mortgage rates are more likely to give them up if their homes no longer serve their needs. They get new jobs, marry, divorce, have children, retire — all reasons that might persuade them to sell even if it means relinquishing a great interest rate. That helps explain why the volume of sub-3 percent mortgages shrinks every month and those above 6 percent have climbed, because most new 30-year mortgages are in the 6 percent range.

But Redfin chief economist Daryl Fairweather said home shoppers shouldn’t expect the recent crossover to make a huge difference. “It’s becoming less of a problem the more that time goes on, but it’s a slow unwinding,” she said.

Read More (subscriber content)

Some stories may only appear as partial reprints because of publisher restrictions.