By Melissa Rosequist | Daily Independent

Low inventory and high housing prices are not just a real estate issue, one economist says, as the threat of economic development consequences across the Valley of the Sun grows more concerning.

However, one local Realtor says the housing inventory is bouncing back quickly and the Valley’s housing market may not be as doom-and-gloom as it was just three months ago.

Scottsdale is among Phoenix suburbs receiving advice to build more housing units — ones of every size and price — before the housing crisis gets worse.

“The reality is, the only real solution is more supply. And more supply at all levels — all types of housing, at all income levels,” said Elliott Pollack, a longtime economist. “Some cities are all over that and understand it, and some cities don’t.”

At Scottsdale City Hall, not all elected councilors agreed with Pollack’s conclusion following a July presentation on the topic.

Further, market inventory is rising quickly, according to real estate experts, citing about 14,000 houses available today — a dramatic increase from March.

“What I know about the market right now is that in general, we are still at a shortage, but we’re quickly, quickly climbing,” said Shelby DiBiase, a longtime Valley Realtor. “For instance, when the market was at the lowest, which was around March of this year, we were around 4,200 listings active on the market, which was extremely low. … Inventory today is 14,717 homes. That number, against March, that’s a huge increase.”

Pollack is working with a 2021 coalition called Home Arizona, a pro-housing advocacy group with a goal to encourage policymakers to understand the housing shortage and potential remedies before the issue becomes an economic development problem.

In April, Home Arizona and Pollack presented a number of findings to Scottsdale’s economic development subcommittee — comprised of three council members — before they were asked to present to the whole council in early July.

“My job isn’t to make any critique of any city, it’s to let cities know what’s going on and especially economic development prospects are to areas that end up having affordability issues,” Pollack told the Independent.

In Scottsdale, Pollack’s data show a number of industries — from police officers to teachers to construction workers and others — can’t afford to buy or rent any housing within the city.

Data provided by Elliott D. Pollack & Co. show since 2000, home costs have increased 233%, while median income has increased only 48.8%. Annual household income needed to own a home in 2020 was $66,067. Now, households need an average of $99,300 to afford a home.

In Scottsdale, the median home price for March 2022 was $795,000. Meanwhile, an average annual salary for a high school teacher is $58,213; a construction worker makes $50,725; wait staff make $38,154; a firefighter makes $58,753; and a police officer makes a median wage of $78,965.

“New employees and new employers are going to have a difficult time, that will spread,” Pollack said. “It will be basically a very difficult economic development issue for Phoenix to deal with, indeed for any city to deal with.”

Data behind the crisis

Data provided by Pollack and Home Arizona, which was sourced from the Maricopa Association of Governments, show how housing inventory has changed during the past two decades in greater Phoenix. In the 2000s, Phoenix had a decade of excess inventory, with a high of 486,980 residential units built. In the 2010s, the Valley experienced a decade of absorbing that inventory, dropping units built to 240,178.

The 240,000 units built in the 2010s is the least amount the area experienced since the 1960s.

Additionally, Pollack reports people in their late 20s and early 30s will be forced to buy homes later than the historic average because of rising interest rates and housing costs. His data show in 2021, the majority of home-purchase loan applications were for people age 27-29. But, in 2026, he estimates the majority of home-purchase loan applications will be made by people in their early to mid 30s.

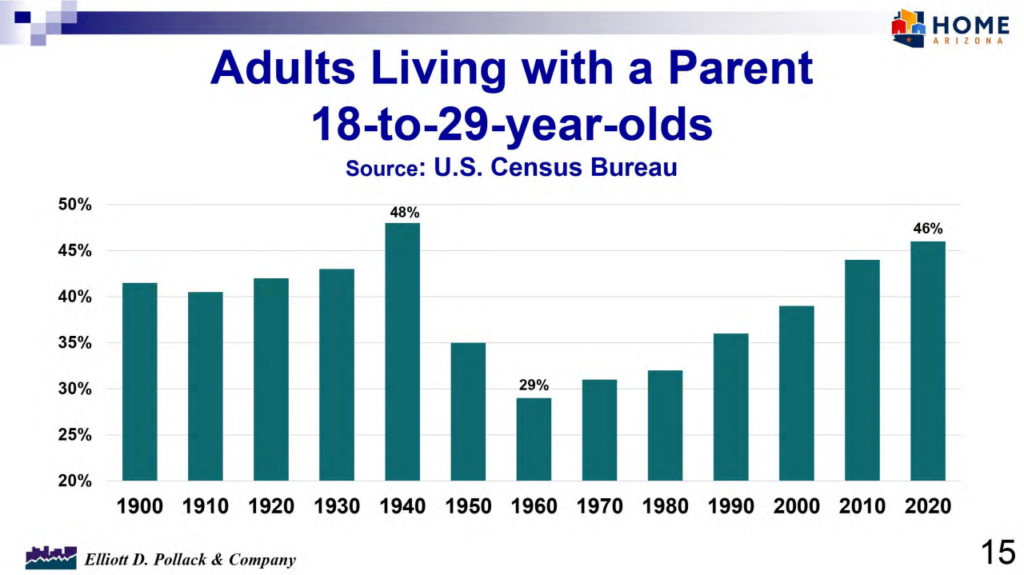

This data is coupled with the fact there is an equivalent amount of young adults in their 20s living with parents as there were in the 1940s, during the Great Depression. Pollack estimates as many as 46% of people ages 18-29 are living with a parent.

Pollack says the region’s current housing shortage is across all housing types, all price levels and all income levels. Home Arizona cites the Valley is short 40,000 homes and apartments, which is driving up mortgages and rents.

“People are pushed out of ownership into apartments,” Pollack says of cities with poor affordability rates.

“That suggests that there’s going to be relatively more apartments than single-family homes, compared to history, built over the next several years because that’s where the demand is. People having been pushed out of housing as, perhaps an unintended consequence of the Fed raising interest rates,” Pollack said. “It doesn’t change the supply and demand issue.”

Read More (subscriber content)

Some stories may only appear as partial reprints because of publisher restrictions.

Related: Scottsdale’s Affordable Housing Situation is Worst in Metro Phoenix