By Angela Gonzales | Phoenix Business Journal

For the first time since the Great Recession, metro Phoenix has dipped into negative home price growth territory, according to the latest S&P Corelogic Case-Shiller Indices released April 25.

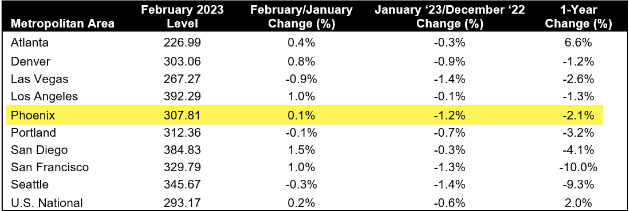

Metro Phoenix saw a 2.1% slide in year-over-year home price growth, joining seven other metros across the country in negative territory, including Denver, Las Vegas, Los Angeles, Portland, San Diego, San Francisco and Seattle.

Sources: S&P Dow Jones Indices and CoreLogic Data thru Feb. 2023.

Phoenix was negative year-over-year every month from February 2007 to February 2010, according to Case-Shiller data, due to lingering effects of the Great Recession. For the 12 months ended March 2009, Phoenix prices were down a whopping 36%. Growth also was negative every month from January 1990 to October 1991.

This is a far cry from Phoenix home price growth topping the nation for three years in a row until last spring. Even when Phoenix dropped to second place nationwide in March 2022, it was still showing a 32.4% gain in home price growth.

While the economy is starting to show signs of slowing, consumer fundamentals — employment, income and wealth — remain supportive of a growing economy, said Selma Hepp, CoreLogic chief economist.

“Nevertheless, with continued inflation and expected credit tightening amid banking turmoil, consumer spending will wane and the U.S. economy is likely to enter a mild recession at some point over the next 12 months,” Hepp said, adding that she doesn’t expect the recession to be as bad in the Phoenix metro.

But the key reason for the price declines is a function of federal reserve policy, said Steven Hensley, advisory manager for Zonda housing market research firm.

“The interest rate hiking cycle directly impacts asset values, which is why prices are falling,” Hensley said. “It also dramatically impacted buyer purchasing power.”

Declining home prices do provide some relief for prospective homebuyers, he said.

“That said, with elevated mortgage interest rates, the relief is minimal,” Hensley said. “Homebuilders in Phoenix have already absorbed most of the price declines and in some cases are beginning to raise prices in select neighborhoods. Affordability is still a challenge in today’s market and lower prices is good for the broader market and economy. An active housing market employs a lot of people.”

Home prices in metro Phoenix are down about 10% from last year’s peak, Hepp said.

“As a result, annual price growth has now started to record negative readings,” she said. “Nevertheless, with monthly price changes starting to increase again, the extent to decline seems to have reached its end.”

See more (subscriber content)

Some stories may only appear as partial reprints because of publisher restrictions.