By Keith Gumbinger | HSH.com

Mortgage interest rates began cycling higher well in advance of the first increase in short-term interest rates. This is not uncommon; inflation running higher than desired in turn lifted expectations that the Fed would lift short-term rates, which in turn has lifted the longer-term rates that influence fixed-rate mortgages.

Also important for this new cycle, is that the Fed is no longer directly supporting the mortgage market by purchasing Mortgage-Backed Securities (which helps to keep that market liquid). This means that a reliable buyer of these instruments — and one that did not care about the level of return on its investment — has left the market.

This leaves only private investors who care very much about making profits on their holdings, and a range of risks to the economic climate may make them more wary of purchasing MBS, particularly at relatively low yields.

At the same time, the Fed is no longer purchasing Treasury bonds to help keep longer-term interest rates low, and so the influential yields on these instruments have risen somewhat as a result.

What the Fed has to say about the future – how quickly or slowly it intends to raise rates or lower rates in 2022 and beyond – will also determine if mortgage rates will rise, and by how much.

At the moment, and given the Fed’s new long-term policy framework, the path for future changes in the federal funds rate is of course uncertain, but the current expectation is that the increase in the federal funds rate will be joined by many others in the coming cycle.

Does a change in the federal funds influence other loan rates?

Although it is an important indicator, the federal funds rate is an interest rate for a very short-term (overnight) loan. This rate does have some influence over a bank’s so-called cost of funds, and changes in this cost of funds can translate into higher (or lower) interest rates on both deposits and loans.

The effect is most clearly seen in the prices of shorter-term loans, including auto, personal loans and even the initial interest rate on some Adjustable Rate Mortgages (ARMs).

However, a change in the overnight rate generally has little to do with long-term mortgage rates (30-year, 15-year, etc.), which are influenced by other factors.

These notably include economic growth and inflation, but also include the whims of investors, too. For more on how mortgage rates are set by the market, see “What moves mortgage rates? (The Basics).”

Does the federal funds rate affect mortgage rates?

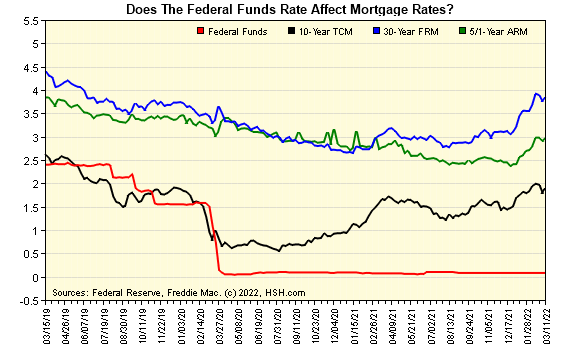

Whenever the Fed makes a change to policy, we are asked the question “Does the federal funds rate affect mortgage rates?”

Just to be clear, the short answer is “no,” as you can see in the linked chart.

That said, the federal funds rate is raised or lowered by the Fed in response to changing economic conditions, and long-term fixed mortgage rates do of course respond to those conditions, and often well in advance of any change in the funds rate.

For example, even though the Fed was still holding the funds rate steady in autumn 2016, fixed mortgage rates rose by better than three quarters of a percentage point amid growing economic strength and a change in investor sentiment about future growth and tax policies during the period.

Read More (subscriber content)

Some stories may only appear as partial reprints because of publisher restrictions.